Bookkeeping Workflow Template

A simple, practical guide to constructing a successful bookkeeping workflow from the ground up.

Download PDF

Download Excel

Download Sheet

Start Your Template with a Checklist

Effective bookkeeping begins with first having a clear understanding of what needs to be accomplished with your work breakdown structure and the order in which each task must be completed.

Once you have that in place, you can take a methodical, systematized approach to accounting for maximum efficiency.

The best way to tackle this is with a bookkeeping checklist template for non-closing and closing tasks.

Once you have that in place, you can take a methodical, systematized approach to accounting for maximum efficiency.

The best way to tackle this is with a bookkeeping checklist template for non-closing and closing tasks.

After you’ve identified each task that must be completed, you can more efficiently move down the list until every box has been checked, and you can be sure that nothing has been missed.

Non-closing tasks can be:

- Record daily transactions

- Deposit money and update cash flow

- Prepare and send invoices to customers

- Pay vendors

- Run payroll every two weeks

- Review your balance sheet at the end of each month

- Do sales tax filing every quarter on the 15th of each 1st month

- Do bill pay on the 10th and 25th of each month

- Review forecasted cash flow

- Review budget

- Record daily transactions

- Deposit money and update cash flow

- Prepare and send invoices to customers

- Pay vendors

- Run payroll every two weeks

- Review your balance sheet at the end of each month

- Do sales tax filing every quarter on the 15th of each 1st month

- Do bill pay on the 10th and 25th of each month

- Review forecasted cash flow

- Review budget

Closing tasks can include:

- Assign tasks and due dates when starting a new close

- Reconcile accounts

- Review transactions

- Review payees

- Review financial statements

- Create income and cash flow statements

- Deliver financial statements

- Transfer revenue earned to the appropriate account

- Assign tasks and due dates when starting a new close

- Reconcile accounts

- Review transactions

- Review payees

- Review financial statements

- Create income and cash flow statements

- Deliver financial statements

- Transfer revenue earned to the appropriate account

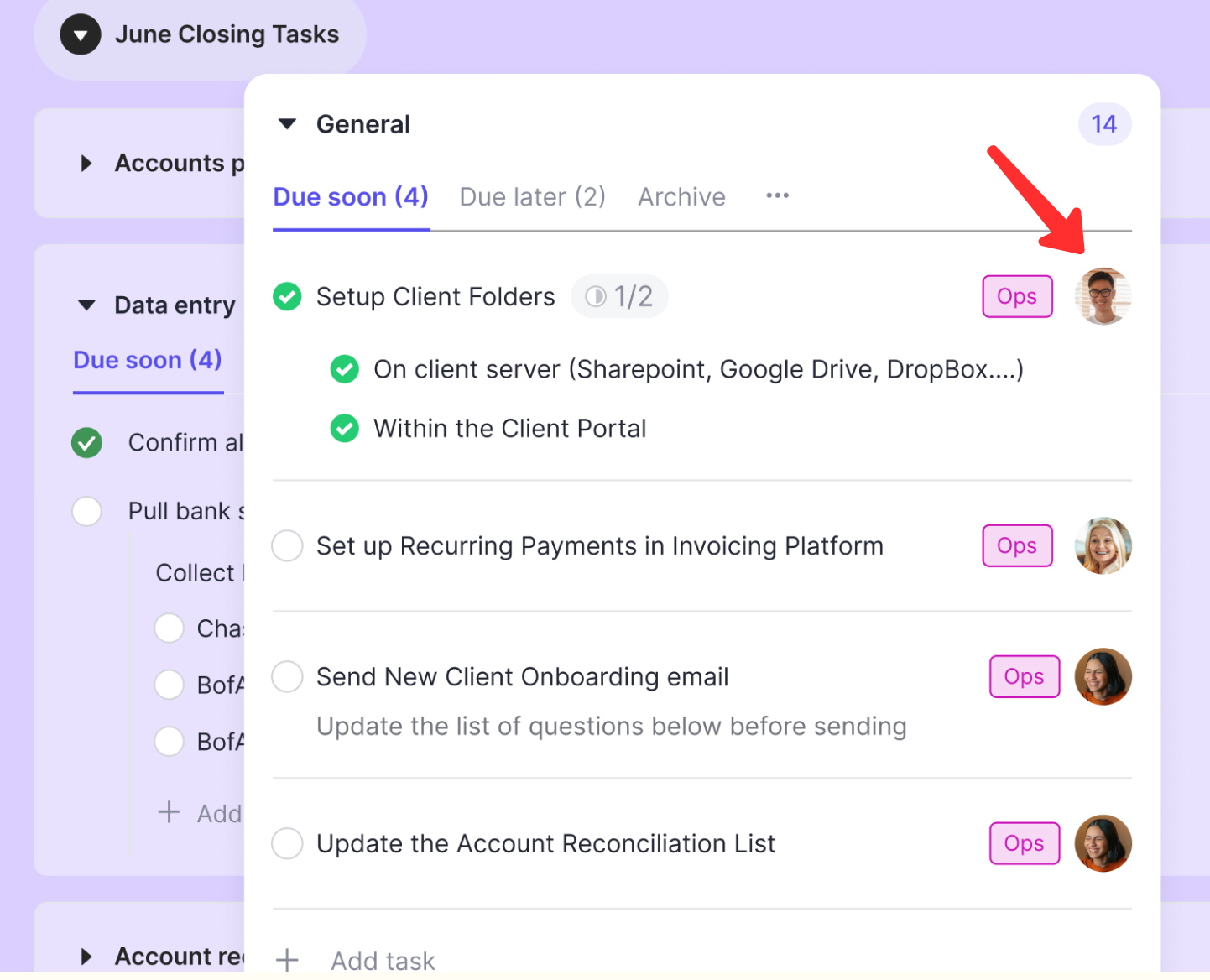

Make Sure the Templates Include Who, Not Just What

One common mistake when approaching workflow automation in accounting teams is including the tasks that need to be completed but not specifying exactly who needs to complete them.

At the end of the day, having success requires robust project management — not just task management.

For example, when creating a list of closing tasks, you may have one accounting professional set up client folders.

You may have another accountant set up recurring payments in an invoicing platform.

And you may have a different person send a new client onboarding email and update the account reconciliation list.

This is a simple example, but you get the idea. By having a clear overview of who’s responsible for what, you’ll be better positioned to develop a streamlined accounting workflow template that helps you close the books quicker without unnecessary hiccups.

At the end of the day, having success requires robust project management — not just task management.

For example, when creating a list of closing tasks, you may have one accounting professional set up client folders.

You may have another accountant set up recurring payments in an invoicing platform.

And you may have a different person send a new client onboarding email and update the account reconciliation list.

This is a simple example, but you get the idea. By having a clear overview of who’s responsible for what, you’ll be better positioned to develop a streamlined accounting workflow template that helps you close the books quicker without unnecessary hiccups.

Nothing should be missed. And if something goes wrong or is delayed, you can instantly trace it back to see what happened.

Not only that, you can eliminate a lot of the annoying back-and-forthing that eats up your team’s valuable time because everyone has a 10,000-foot view of accounting activities.

Not only that, you can eliminate a lot of the annoying back-and-forthing that eats up your team’s valuable time because everyone has a 10,000-foot view of accounting activities.

Use Software that Automates Templates

Research says that 38% of finance teams spend more than 25% of their time on repetitive, manual tasks. For 11% of teams, more than half of their time goes to those tasks.

And it’s easy to see why. When team members get caught up in tedious day-to-day activities to the point that it prevents them from focusing on “big picture” tasks, it hurts their efficiency. If left unchecked, this can quickly eat away at your productivity and push back your month-end close.

A big part of optimizing your accounting workflow template is leveraging bookkeeping software for accountants that automates task templates so you can get more done in less time, with less manpower.

With Keeper, for instance, you can apply an invoice template or related templates, which will overwrite things like assignee, due date, and description. Instead of having to manually update multiple fields, you can use a template to instantly update each field for an automated workflow experience.

That way, you don’t have to spend extra time performing repetitive tasks, and instead, can use a simple bookkeeping template to significantly speed up your accounting workflow.

On the small scale, it may not seem like the impact is that major. But when you zoom out on a large scale over the course of a week, month, and year, the impact can be staggering.

You can learn more about how Keeper templates work here and their automation capabilities.

And it’s easy to see why. When team members get caught up in tedious day-to-day activities to the point that it prevents them from focusing on “big picture” tasks, it hurts their efficiency. If left unchecked, this can quickly eat away at your productivity and push back your month-end close.

A big part of optimizing your accounting workflow template is leveraging bookkeeping software for accountants that automates task templates so you can get more done in less time, with less manpower.

With Keeper, for instance, you can apply an invoice template or related templates, which will overwrite things like assignee, due date, and description. Instead of having to manually update multiple fields, you can use a template to instantly update each field for an automated workflow experience.

That way, you don’t have to spend extra time performing repetitive tasks, and instead, can use a simple bookkeeping template to significantly speed up your accounting workflow.

On the small scale, it may not seem like the impact is that major. But when you zoom out on a large scale over the course of a week, month, and year, the impact can be staggering.

You can learn more about how Keeper templates work here and their automation capabilities.

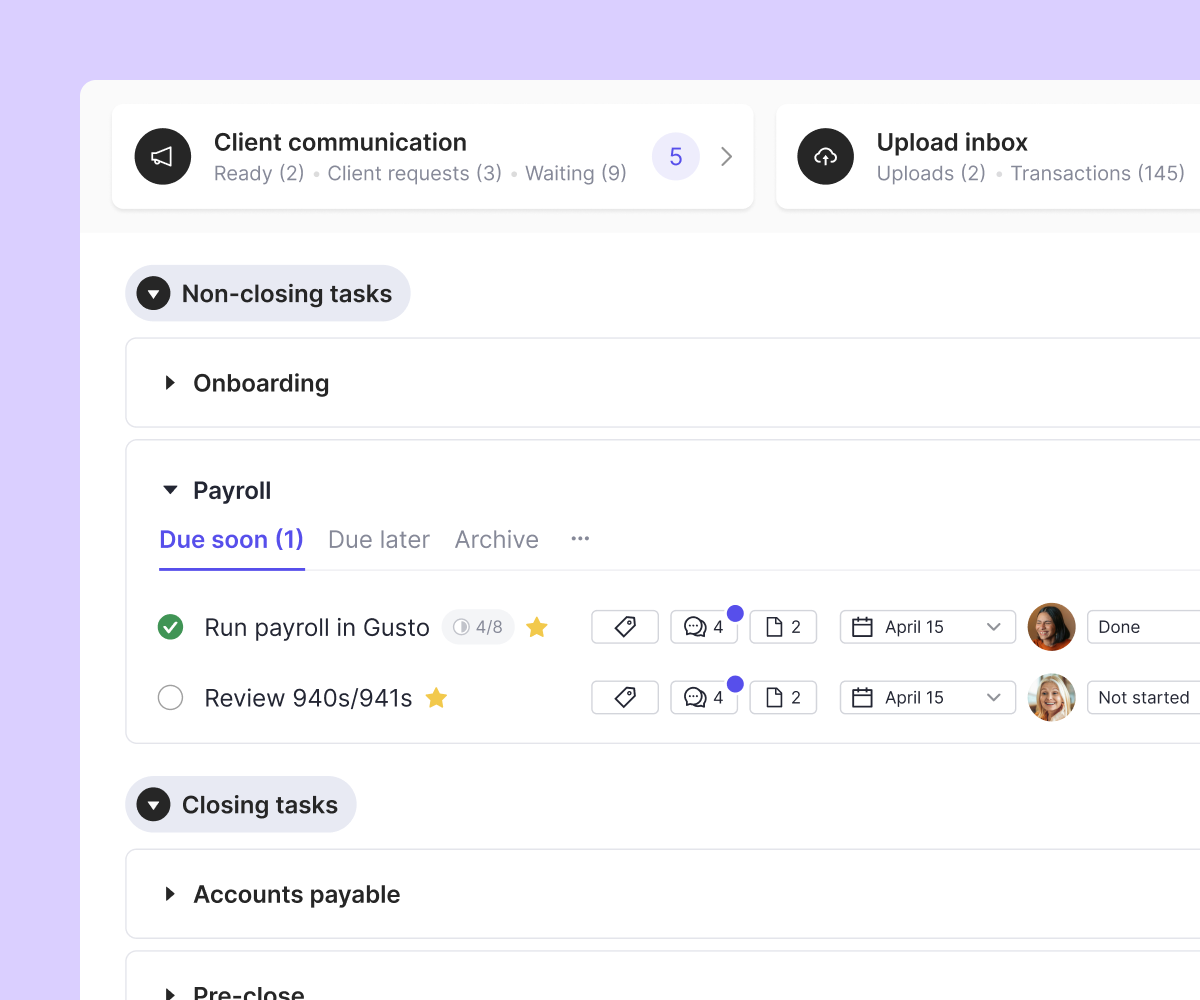

Use Project Management (PM) Software

As you probably know, monthly bookkeeping can get complicated and chaotic in a hurry, especially when you’re managing multiple clients.

From coordinating tasks with other team members to communicating with clients to tracking progress to document management and beyond—it’s crucial to have a workflow process to quell the chaos.

Fortunately, PM software offers everything you need to keep your accounting practice running smoothly.

Here are some specific ways to use this type of software to improve your bookkeeping process.

- Organize tasks from a centralized dashboard for a bird’s-eye view

- Assign tasks to appropriate team members

- Share information like Google Docs and Google Sheets without the need for email

- Monitor progress from start to finish

- Receive instant notifications when something needs your attention

- Track activities to determine where problems originated for quick resolution

Note that bookkeepers are no longer limited to clunky third-party software that has to be 100% customized to be functional. Keeper offers dedicated, all-encompassing accounting practice management software for all client work that can handle virtually any task imaginable.

From coordinating tasks with other team members to communicating with clients to tracking progress to document management and beyond—it’s crucial to have a workflow process to quell the chaos.

Fortunately, PM software offers everything you need to keep your accounting practice running smoothly.

Here are some specific ways to use this type of software to improve your bookkeeping process.

- Organize tasks from a centralized dashboard for a bird’s-eye view

- Assign tasks to appropriate team members

- Share information like Google Docs and Google Sheets without the need for email

- Monitor progress from start to finish

- Receive instant notifications when something needs your attention

- Track activities to determine where problems originated for quick resolution

Note that bookkeepers are no longer limited to clunky third-party software that has to be 100% customized to be functional. Keeper offers dedicated, all-encompassing accounting practice management software for all client work that can handle virtually any task imaginable.

Use a Client Relationship Manager (CRM)

Efficiently managing and keeping track of clients is essential to creating a well-crafted bookkeeping workflow template. So the last piece of the puzzle is using a CRM to store all client accounting information in one place.

Not only does this provide your entire team with a single reference point via a client portal, but data can also be seamlessly added and updated in real time so you always have a current view of what’s happening.

With a CRM, you can store all client information in one place for quick reference, including contact information, financial history, and relevant documents. You can add critical documents like invoices, receipts, and tax returns.

You can even record important interactions like phone calls, emails, support issues, and resolutions for a 360-degree view of each client’s history.

Rather than making your team hunt this information down from different places, a CRM condenses it perfectly, saving your bookkeeping service a ton of time that can be devoted to more important tasks.

Not only does this provide your entire team with a single reference point via a client portal, but data can also be seamlessly added and updated in real time so you always have a current view of what’s happening.

With a CRM, you can store all client information in one place for quick reference, including contact information, financial history, and relevant documents. You can add critical documents like invoices, receipts, and tax returns.

You can even record important interactions like phone calls, emails, support issues, and resolutions for a 360-degree view of each client’s history.

Rather than making your team hunt this information down from different places, a CRM condenses it perfectly, saving your bookkeeping service a ton of time that can be devoted to more important tasks.

Use Keeper to Create, Organize, and Assign Bookkeeping Workflow Templates

Leveraging the right technology is a huge part of building out a successful bookkeeping workflow template. Keeper is a platform that’s revolutionized the process for many bookkeepers and accountants.

It’s the first bookkeeping practice management software that integrates with both QuickBooks Online and Xero and can help you optimize all areas of your bookkeeping workflow.

It’s the first bookkeeping practice management software that integrates with both QuickBooks Online and Xero and can help you optimize all areas of your bookkeeping workflow.

With Keeper, you can conveniently create, organize, and assign bookkeeping workflow templates for non-closing and closing tasks to keep your operations firing on all cylinders.

Because everything is done with one workflow management software, you don’t have to constantly jump between three or four programs to close the books, which can dramatically speed up your month-end close.

In fact, many bookkeepers close their books 50% faster with Keeper.

Learn more about this bookkeeping workflow software and its full capabilities.

From automated file review to task organization to 1099s to custom reports—it’s all there. If you’ve ever wanted to use this accounting technology but have been reluctant because of the lack of a dedicated platform, you’ll want to check out Keeper.

Because everything is done with one workflow management software, you don’t have to constantly jump between three or four programs to close the books, which can dramatically speed up your month-end close.

In fact, many bookkeepers close their books 50% faster with Keeper.

Learn more about this bookkeeping workflow software and its full capabilities.

From automated file review to task organization to 1099s to custom reports—it’s all there. If you’ve ever wanted to use this accounting technology but have been reluctant because of the lack of a dedicated platform, you’ll want to check out Keeper.