Month-End Close Checklist

Save time and promote accuracy with this comprehensive month-end close checklist.

Download Excel

Download Google Sheet

What Is the Month-End Close Process?

The month-end close process is a bookkeeping and accounting process that involves reviewing, reconciling, and finalizing a business’s financial records each month. For example, it typically includes steps like:

- Reviewing uncategorized transactions

- Reconciling records to account statements

Entering and adjusting journal entries

Implementing a month-end close isn’t necessarily required for every business, but it can contribute greatly to having useful and accurate financial reporting systems.

With timely access to accurate financial information, you’re much better equipped for financial planning activities, such as budgeting, cash flow forecasting, and scenario planning. As a result, it’s much easier to make informed strategic decisions.

- Reviewing uncategorized transactions

- Reconciling records to account statements

Entering and adjusting journal entries

Implementing a month-end close isn’t necessarily required for every business, but it can contribute greatly to having useful and accurate financial reporting systems.

With timely access to accurate financial information, you’re much better equipped for financial planning activities, such as budgeting, cash flow forecasting, and scenario planning. As a result, it’s much easier to make informed strategic decisions.

Additionally, ensuring financial statements are up to date throughout the year ensures you’re always prepared for tax compliance, so you don’t have to scramble to get records in order just before deadlines.

That’s also much easier to do when you only have a month of activities to resolve and memories of them are fresh. A quarter- or year-end close gives much more time for minor errors to compound and the recollection of critical details to fade.

That’s also much easier to do when you only have a month of activities to resolve and memories of them are fresh. A quarter- or year-end close gives much more time for minor errors to compound and the recollection of critical details to fade.

8 Essential Month-End Close Steps

1. Create a Closing Schedule

The first step in a successful month-end close is to create a closing schedule, which is a checklist of the tasks you want to include in the process. It gives the accounting or finance team structure, which can be invaluable for such a frequently recurring project.

Not only does it help prevent missed steps and inconsistencies between closes for the accounting department as a whole, but it also provides each team member a reference for the tasks they’re responsible for completing.

By standardizing the month-end close, even brand-new staff members will know how to stay on track, and you’ll eventually save time and improve accuracy as they become increasingly familiar with the process.

Not only does it help prevent missed steps and inconsistencies between closes for the accounting department as a whole, but it also provides each team member a reference for the tasks they’re responsible for completing.

By standardizing the month-end close, even brand-new staff members will know how to stay on track, and you’ll eventually save time and improve accuracy as they become increasingly familiar with the process.

2. Record Revenues

The first step in a month-end closing schedule is typically to record revenues. It involves recognizing income from the sale of products and services and net of certain adjustments, like returns and discounts.

Month-end closes typically start with revenue because it’s at the top of the income statement and one of the primary foundations for all three financial statements.

When following the cash accounting method, recording revenues should be relatively straightforward. You only need to reference the cash account’s activity and recognize revenues when received.

When using the accrual accounting method, this step becomes more complicated, as you must recognize revenues only when earned.

Month-end closes typically start with revenue because it’s at the top of the income statement and one of the primary foundations for all three financial statements.

When following the cash accounting method, recording revenues should be relatively straightforward. You only need to reference the cash account’s activity and recognize revenues when received.

When using the accrual accounting method, this step becomes more complicated, as you must recognize revenues only when earned.

3. Record Expenses

After revenues, the monthly closing process usually continues with the recording of expense accounts. In addition to double-checking that costs are accounted for, this involves assigning them the proper categories and payees.

Start with the cost of sales, which are the expenses directly involved in making products or services ready for sale. For example, that may include direct labor, direct materials, and any manufacturing overhead.

Next, make sure operating expenses are recorded properly. Those are the costs incurred in day-to-day activities that aren’t directly related to the primary offering, such as professional services, marketing, insurance, and interest.

Again, this is more challenging under the accrual basis than the cash basis, as it requires recording costs incurred, not just paid. However, you’ll need to record certain expenses via journal entry either way, such as non-cash ones like depreciation.

Start with the cost of sales, which are the expenses directly involved in making products or services ready for sale. For example, that may include direct labor, direct materials, and any manufacturing overhead.

Next, make sure operating expenses are recorded properly. Those are the costs incurred in day-to-day activities that aren’t directly related to the primary offering, such as professional services, marketing, insurance, and interest.

Again, this is more challenging under the accrual basis than the cash basis, as it requires recording costs incurred, not just paid. However, you’ll need to record certain expenses via journal entry either way, such as non-cash ones like depreciation.

4. Reconcile Customer Invoices and Payments

The primary goal of the month-end close process is to ensure that all financial activities are documented accurately, which requires reconciling accounts to several different external sources.

Once again, it’s often best to start at the top of the income statement. To double-check the accuracy of recorded revenues, reconcile the payments received to the invoices sent to customers.

Look for any potential discrepancies caused by differences in payment amounts, missing payments, or undocumented returns. At this step, you can also consider conducting an accounts receivable aging and following up on outstanding invoices.

Once again, it’s often best to start at the top of the income statement. To double-check the accuracy of recorded revenues, reconcile the payments received to the invoices sent to customers.

Look for any potential discrepancies caused by differences in payment amounts, missing payments, or undocumented returns. At this step, you can also consider conducting an accounts receivable aging and following up on outstanding invoices.

5. Reconcile to Bank and Credit Card Statements

Moving down the income statement, the next essential step in the month-end close is to double-check the accuracy of recorded expenses by reconciling them to bank and credit card statements.

Fortunately, modern accounting software has significantly streamlined this step. Even most basic solutions tend to have bank and credit card reconciliation features built in that all but automate the process.

If you have to do things manually, make sure that no transactions are present on one side and missing on another. Then, double-check that their dates, amounts, categories, and payees match.

Fortunately, modern accounting software has significantly streamlined this step. Even most basic solutions tend to have bank and credit card reconciliation features built in that all but automate the process.

If you have to do things manually, make sure that no transactions are present on one side and missing on another. Then, double-check that their dates, amounts, categories, and payees match.

6. Reconcile Payroll

Assuming the business has employees, another essential income-statement-related step in the monthly close process is to reconcile payroll expenses, ensuring all wages, benefits, bonuses, and taxes are properly recorded.

Payroll reconciliation is an especially critical step because:

- Payroll is often one of the largest business expenses

- Compensating employees properly is essential to retaining talent

- Inaccurate payroll records can jeopardize tax compliance

Payroll reconciliation can be complex, but it’s another step that you may be able to essentially automate with the assistance of a third-party payroll provider and payroll management software.

Payroll reconciliation is an especially critical step because:

- Payroll is often one of the largest business expenses

- Compensating employees properly is essential to retaining talent

- Inaccurate payroll records can jeopardize tax compliance

Payroll reconciliation can be complex, but it’s another step that you may be able to essentially automate with the assistance of a third-party payroll provider and payroll management software.

7. Reconcile Cash

In addition to verifying the income statement, the month-end close should involve steps that confirm the accuracy of the balance sheet. One of the most significant is to reconcile the cash account balance to its bank balance.

While there is often a significant overlap between cash reconciliation and reconciling expenses to bank statements, there may be some additional cash activities you need to account for separately.

For example, there may be transactions that the bank statements don’t capture, such as those facilitated with petty cash reserves, or outstanding checks that have been issued but have yet to clear.

While there is often a significant overlap between cash reconciliation and reconciling expenses to bank statements, there may be some additional cash activities you need to account for separately.

For example, there may be transactions that the bank statements don’t capture, such as those facilitated with petty cash reserves, or outstanding checks that have been issued but have yet to clear.

8. Prepare Financial Reports

The ultimate step in every financial close is to generate financial reports that document the business’s financial data and key performance indicators. While these can vary somewhat, they always include the following monthly financial statements:

Balance sheet: This captures assets, liabilities, and equity accounts, summarizing the financial position on a given date.

Income statement: This captures revenues and expenses, summarizing financial performance during a given period.

Cash flow statement: This captures cash inflows and outflows from operating, financing, and investing activities, summarizing net cash flows during a given period.

In addition to preparing each financial report, consider incorporating routine analysis of them into the month-end close process. It’s not essential for creating accurate records, but it can generate insights that contribute to better-informed business decisions.

Balance sheet: This captures assets, liabilities, and equity accounts, summarizing the financial position on a given date.

Income statement: This captures revenues and expenses, summarizing financial performance during a given period.

Cash flow statement: This captures cash inflows and outflows from operating, financing, and investing activities, summarizing net cash flows during a given period.

In addition to preparing each financial report, consider incorporating routine analysis of them into the month-end close process. It’s not essential for creating accurate records, but it can generate insights that contribute to better-informed business decisions.

Use Keeper To Speed Up Your Month-End Close

Closing the books each month is time-consuming and one of the most manual processes in bookkeeping. However, this is often due to a lack of bookkeeping workflow software.

54% of businesses that use automation to streamline most or all of their close-related workflows are able to complete the even more rigorous quarterly close within six business days, compared to only 21% of those that don’t use software.

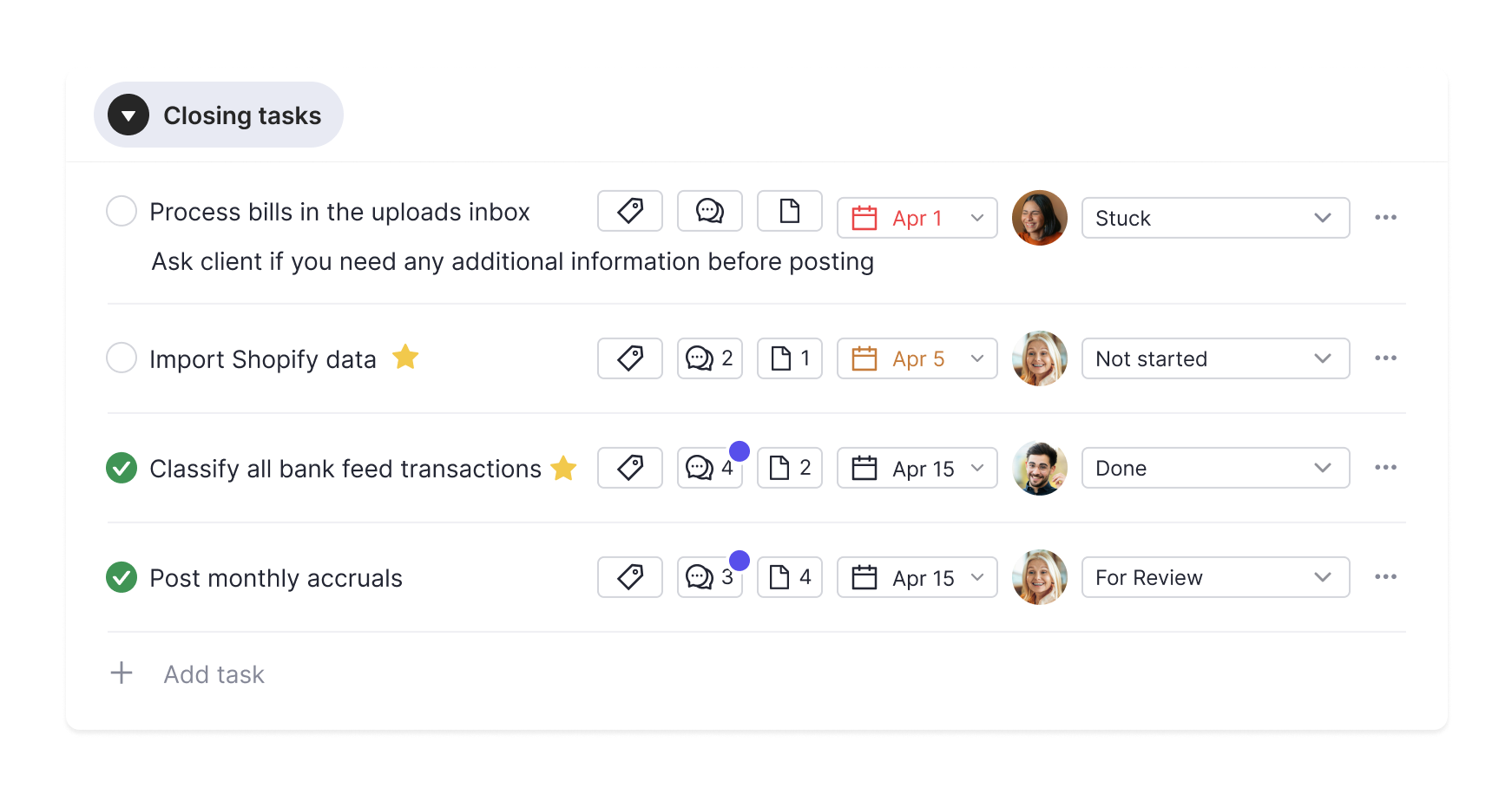

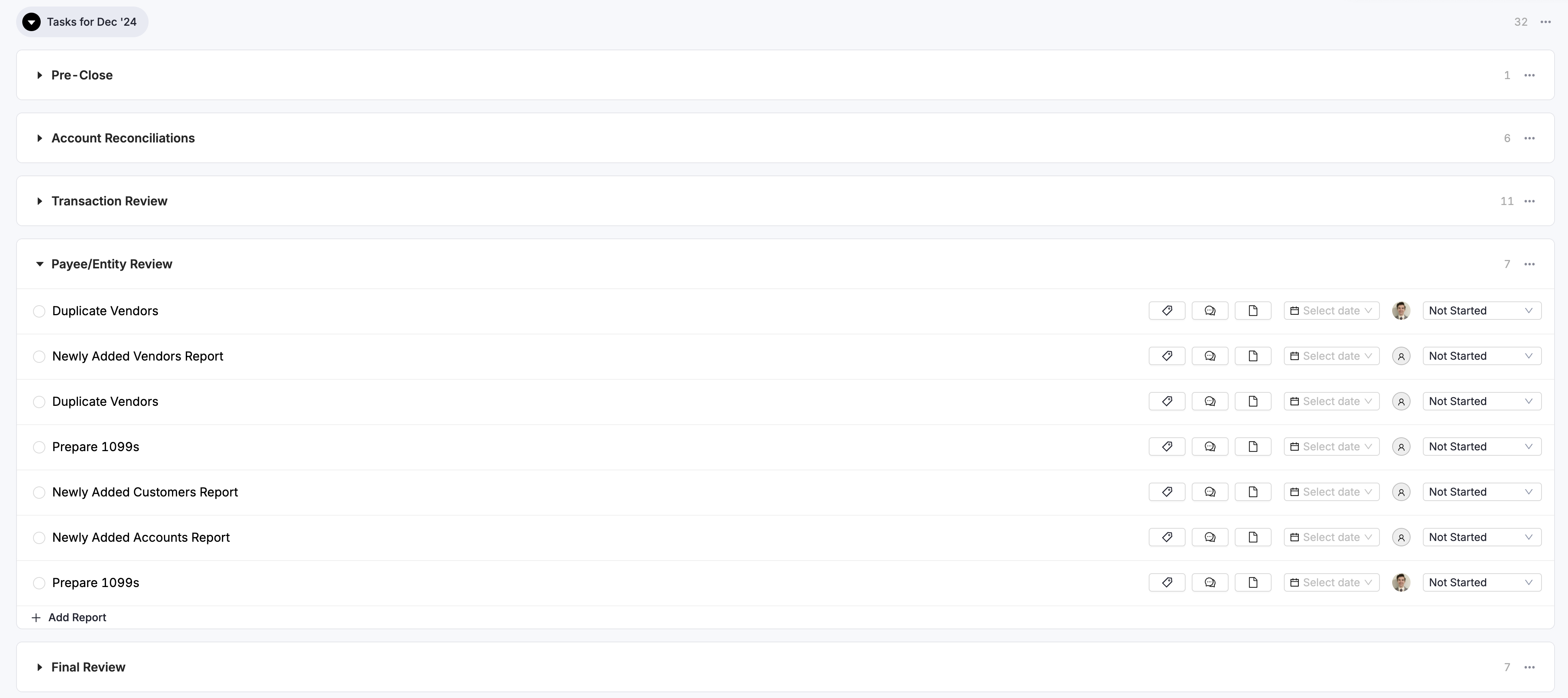

If you’re a bookkeeper or accountant looking for a tool that can speed up your month-end process, Keeper’s bookkeeping practice management software can help. Close books up to 50% faster with its powerful features, which include:

- Project management and task categorization tools for your accounting team

- A client portal that facilitates communication and collaboration

- File review automation that reveals inconsistent or missing financial transaction data

Keeper also syncs upstream with your client’s bookkeeping software, automatically updating their general ledger after you complete your month-end close. Book a demo today to see why thousands of accountants trust Keeper to power their practice.

54% of businesses that use automation to streamline most or all of their close-related workflows are able to complete the even more rigorous quarterly close within six business days, compared to only 21% of those that don’t use software.

If you’re a bookkeeper or accountant looking for a tool that can speed up your month-end process, Keeper’s bookkeeping practice management software can help. Close books up to 50% faster with its powerful features, which include:

- Project management and task categorization tools for your accounting team

- A client portal that facilitates communication and collaboration

- File review automation that reveals inconsistent or missing financial transaction data

Keeper also syncs upstream with your client’s bookkeeping software, automatically updating their general ledger after you complete your month-end close. Book a demo today to see why thousands of accountants trust Keeper to power their practice.